In today's fast-paced financial world, TD Card Services has emerged as a leader in providing comprehensive credit card solutions. Whether you're looking for a reliable credit card provider or aiming to manage your finances more effectively, TD Card Services offers a wide range of options tailored to meet individual and business needs. With a reputation for excellence, this service provider continues to set the standard in the financial industry.

As consumers navigate an increasingly complex financial landscape, choosing the right credit card provider is crucial. TD Card Services not only provides competitive rates and benefits but also prioritizes customer satisfaction and trust. By combining cutting-edge technology with personalized service, TD Card Services ensures that its customers receive the best possible experience.

In this comprehensive guide, we will explore everything you need to know about TD Card Services. From understanding their product offerings to learning about their customer support and security measures, this article will provide you with the tools and knowledge to make informed decisions about your financial future. Let's dive in and discover why TD Card Services is a trusted name in the financial sector.

Read also:Meet The Blippi Actor Behind The Scenes

Table of Contents

- About TD Card Services

- Product Offerings

- Benefits of TD Card Services

- Customer Support

- Security Measures

- Fees and Charges

- Eligibility Requirements

- Comparison with Other Providers

- Testimonials and Reviews

- Frequently Asked Questions

About TD Card Services

TD Card Services is a division of TD Bank Group, one of the largest financial institutions in North America. Established with a mission to provide innovative financial solutions, TD Card Services has grown to become a trusted name in the credit card industry. With a focus on delivering exceptional customer service, TD Card Services continues to expand its offerings to meet the evolving needs of its customers.

History of TD Card Services

The journey of TD Card Services began as part of the broader TD Bank Group, which traces its roots back to 1853. Over the years, TD Bank Group has expanded its operations across Canada and the United States, establishing itself as a leader in financial services. TD Card Services specifically focuses on credit card solutions, leveraging the extensive resources and expertise of the TD Bank Group to provide top-notch services.

Mission and Vision

TD Card Services is committed to empowering its customers to achieve financial success. The company's mission is to provide accessible, transparent, and reliable financial solutions that cater to diverse customer needs. With a vision to be the preferred credit card provider in North America, TD Card Services consistently strives to innovate and improve its offerings.

Product Offerings

TD Card Services offers a wide range of credit card products designed to suit various customer profiles. Whether you're a frequent traveler, a small business owner, or someone looking to build credit, TD Card Services has a solution tailored just for you.

Types of Credit Cards

- Reward Cards: Earn points, cashback, or miles with every purchase.

- Travel Cards: Exclusive benefits for travelers, including airport lounge access and travel insurance.

- Business Cards: Designed for small business owners, offering expense management tools and rewards.

- Low-Interest Cards: Ideal for customers seeking to minimize interest payments.

Exclusive Benefits

TD Card Services provides additional perks such as purchase protection, extended warranty coverage, and fraud monitoring. These benefits enhance the value of their credit card offerings, making them an attractive choice for consumers.

Benefits of TD Card Services

Choosing TD Card Services comes with numerous advantages that set it apart from competitors. Below are some of the key benefits:

Read also:Exclusive Camilla Araujo Onlyfans Leaks Shocking Details

Customer-Centric Approach

TD Card Services prioritizes customer satisfaction by offering personalized service and tailored solutions. Their dedicated team ensures that customers receive the support they need to manage their finances effectively.

Competitive Rates and Fees

With competitive interest rates and minimal fees, TD Card Services ensures that its customers can maximize the value of their credit cards. Additionally, many of their cards offer no annual fees, making them accessible to a wider audience.

Customer Support

TD Card Services understands the importance of reliable customer support. Their team is available 24/7 to assist customers with any inquiries or issues they may encounter. Whether it's resolving disputes or providing account updates, TD Card Services ensures that its customers receive prompt and efficient service.

Multi-Channel Support

Customers can reach TD Card Services through various channels, including phone, email, and live chat. This multi-channel approach ensures that customers can choose the most convenient method of communication for their needs.

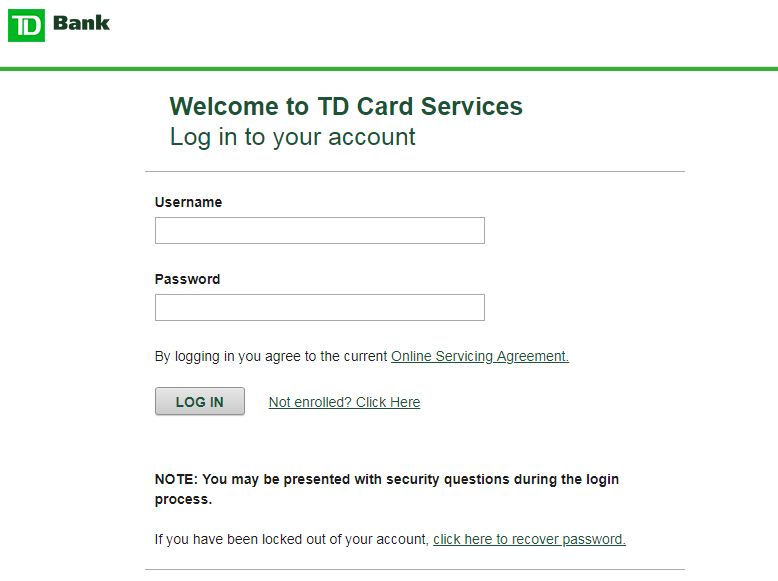

Self-Service Options

In addition to traditional support methods, TD Card Services offers self-service options through their online portal and mobile app. These tools allow customers to manage their accounts, view transactions, and make payments with ease.

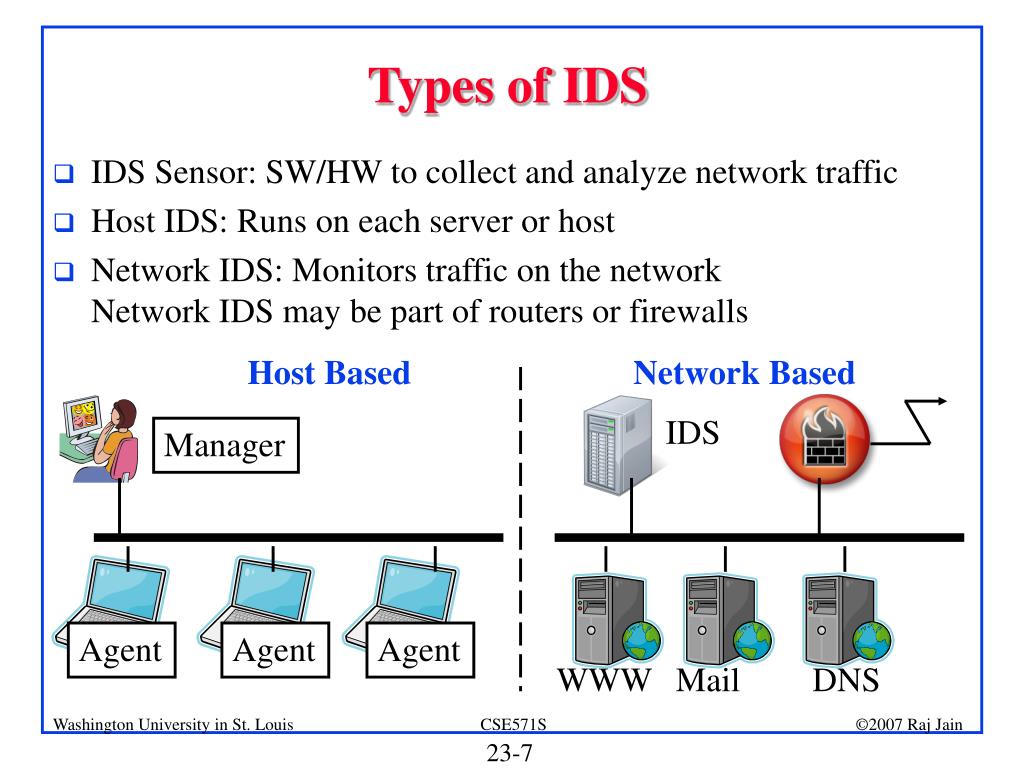

Security Measures

Security is a top priority for TD Card Services. The company employs advanced technologies and protocols to protect customer data and prevent fraud. By implementing robust security measures, TD Card Services ensures that its customers can transact with confidence.

Fraud Detection and Prevention

TD Card Services utilizes state-of-the-art fraud detection systems to monitor suspicious activities and alert customers promptly. This proactive approach helps mitigate potential risks and safeguards customer accounts.

Data Encryption

All customer data is encrypted using the latest security standards, ensuring that sensitive information remains protected at all times. TD Card Services adheres to industry regulations and compliance standards to maintain the highest level of security.

Fees and Charges

Understanding the fees and charges associated with credit cards is essential for making informed financial decisions. TD Card Services provides transparent information regarding their fee structure, allowing customers to plan their finances accordingly.

Common Fees

- Annual Fee: Varies depending on the card type, with many cards offering no annual fee.

- Foreign Transaction Fee: Applicable for transactions made in foreign currencies.

- Late Payment Fee: Charged for missed or late payments.

Interest Rates

TD Card Services offers competitive interest rates that are clearly disclosed to customers. These rates may vary based on factors such as creditworthiness and card type.

Eligibility Requirements

To apply for a TD Card Services credit card, customers must meet certain eligibility criteria. These requirements ensure that applicants are capable of managing their credit responsibly.

Credit Score

A good credit score is typically required to qualify for TD Card Services' premium cards. However, they also offer options for customers with average credit scores, making their services accessible to a broader audience.

Income Verification

Applicants may be required to provide proof of income to demonstrate their ability to repay credit card balances. TD Card Services evaluates each application carefully to determine the appropriate credit limit and terms.

Comparison with Other Providers

TD Card Services stands out from its competitors by offering a unique combination of benefits, security, and customer support. Below is a comparison of TD Card Services with other major credit card providers:

Key Differentiators

- Personalized Service: TD Card Services excels in providing tailored solutions to meet individual customer needs.

- Security Features: Advanced fraud detection and data encryption set TD Card Services apart from competitors.

- Competitive Rates: TD Card Services consistently offers competitive interest rates and fees compared to industry standards.

Testimonials and Reviews

Customer feedback plays a crucial role in evaluating the quality of a service provider. TD Card Services has received numerous positive testimonials and reviews from satisfied customers. Below are some highlights:

Customer Testimonials

"TD Card Services has been a reliable partner in managing my finances. Their reward programs and customer support are unmatched!"

"I appreciate the transparency and security measures provided by TD Card Services. It gives me peace of mind knowing my financial information is protected."

Online Reviews

TD Card Services consistently receives high ratings on review platforms, with many customers praising their ease of use, benefits, and overall value.

Frequently Asked Questions

Below are some common questions about TD Card Services:

How do I apply for a TD Card Services credit card?

You can apply online through the TD Card Services website or visit a local TD Bank branch to submit your application.

What happens if I miss a payment?

If you miss a payment, you may incur a late payment fee. However, TD Card Services offers grace periods and flexible repayment options to assist customers in managing their accounts.

Can I use my TD Card Services credit card internationally?

Yes, TD Card Services credit cards are accepted worldwide. However, foreign transaction fees may apply for purchases made in foreign currencies.

Conclusion

In conclusion, TD Card Services offers a comprehensive suite of credit card solutions designed to meet the diverse needs of its customers. With a strong emphasis on security, customer service, and competitive rates, TD Card Services has established itself as a leader in the financial industry. By choosing TD Card Services, you gain access to reliable financial tools and resources to help you achieve your financial goals.

We invite you to explore the wide range of products and services offered by TD Card Services. Don't hesitate to leave a comment or share this article with others who may benefit from the information provided. For more insights into financial management, be sure to check out our other articles on the website.