Nate Anderson Hindenburg Research has become one of the most talked-about names in the world of financial investigations. The name evokes curiosity and intrigue, especially for those interested in corporate accountability, stock market dynamics, and whistleblower activism. In this article, we will delve deep into the background of Nate Anderson, the man behind Hindenburg Research, and explore the impact of his work on global financial markets.

Nate Anderson's journey as the founder of Hindenburg Research has been nothing short of extraordinary. By exposing corporate fraud and unethical practices, he has earned a reputation as a watchdog for investors. However, his methods and findings have also sparked debates, making him both admired and criticized in equal measure.

This article aims to provide a comprehensive understanding of Nate Anderson's career, the significance of Hindenburg Research, and the controversies surrounding it. Whether you're a seasoned investor, a curious reader, or someone interested in corporate governance, this article will equip you with insights into the world of short-selling and investigative journalism.

Read also:Onlyfans Sophie Rain Exclusive Content Photos

Table of Contents

- Biography of Nate Anderson

- What is Hindenburg Research?

- Insights into the Founder

- Investigative Methods Used by Hindenburg Research

- Key Findings and Investigations

- Controversies Surrounding Nate Anderson

- The Impact of Hindenburg Research on Markets

- Regulatory Response to Hindenburg Research

- Future Outlook for Hindenburg Research

- Conclusion and Takeaways

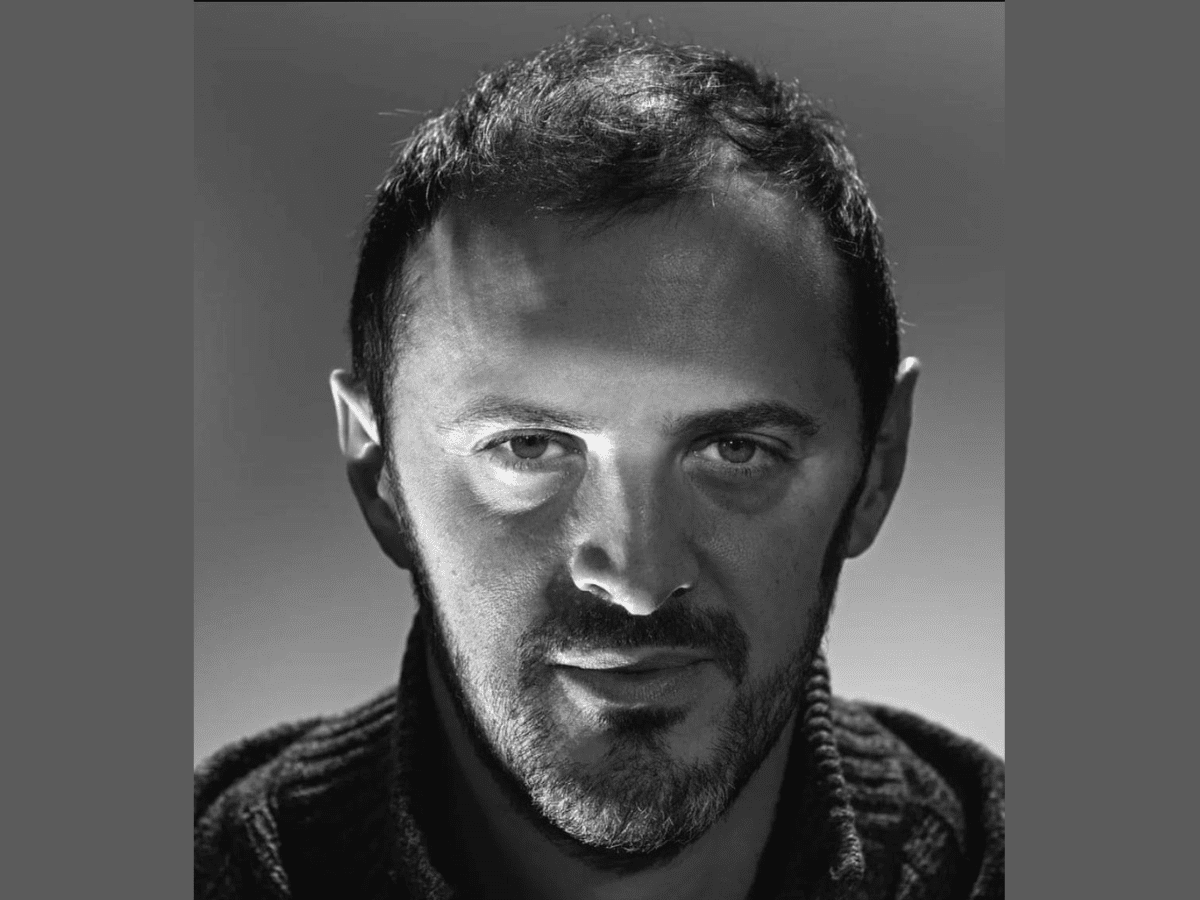

Biography of Nate Anderson

Early Life and Education

Nate Anderson, the brains behind Hindenburg Research, hails from a modest background but quickly rose to prominence in the financial world. Born in the United States, Anderson developed a keen interest in finance and ethics from a young age. His educational foundation laid the groundwork for his future endeavors in investigative research.

Professional Career

Anderson's professional career began in traditional finance before he transitioned into investigative work. His dissatisfaction with corporate misconduct and lack of transparency drove him to found Hindenburg Research. This venture would become a platform for exposing unethical practices in the corporate world.

Biodata

| Full Name | Nate Anderson |

|---|---|

| Date of Birth | Not publicly disclosed |

| Occupation | Founder and Lead Investigator at Hindenburg Research |

| Education | Bachelor’s Degree in Finance |

| Notable Achievements | Multiple high-profile investigations leading to stock price drops and regulatory scrutiny |

What is Hindenburg Research?

Hindenburg Research is a research firm that specializes in uncovering corporate fraud and unethical practices. Founded by Nate Anderson, it operates primarily as a short-selling firm, meaning it profits from exposing companies with inflated valuations or fraudulent activities. The firm's reports often lead to significant drops in stock prices, drawing attention from regulators and investors alike.

Objective of Hindenburg Research

The primary objective of Hindenburg Research is to promote transparency and accountability in the corporate world. By publishing detailed reports on companies suspected of fraudulent activities, the firm aims to protect investors and ensure fair market practices.

Insights into the Founder

Nate Anderson's journey as a financial investigator is marked by his relentless pursuit of truth. His dedication to exposing corporate malfeasance has earned him both praise and criticism. Anderson's background in traditional finance provides him with a unique perspective on the intricacies of corporate operations and financial reporting.

Investigative Methods Used by Hindenburg Research

Hindenburg Research employs a variety of methods to uncover fraudulent practices. These include:

Read also:Movierulz Kannada Movies

- Extensive financial analysis

- On-the-ground investigations

- Data mining and whistleblower reports

- Collaboration with industry experts

Each investigation is meticulously planned and executed to ensure accuracy and credibility.

Key Findings and Investigations

Notable Investigations

Some of the most notable investigations by Hindenburg Research include:

- Wirecard scandal

- Adani Group allegations

- Herbalife Nutrition controversy

These investigations have had significant impacts on the stock prices of the companies involved and have led to increased regulatory scrutiny.

Controversies Surrounding Nate Anderson

While Nate Anderson and Hindenburg Research have garnered praise for their work, they have also faced criticism. Critics argue that the firm's short-selling strategies may sometimes lead to market manipulation. Additionally, some companies targeted by Hindenburg Research have accused the firm of spreading misinformation.

The Impact of Hindenburg Research on Markets

The impact of Hindenburg Research on global financial markets cannot be overstated. The firm's reports often lead to immediate drops in stock prices, prompting regulators to investigate the allegations further. This has resulted in increased transparency and accountability in the corporate world.

Regulatory Response to Hindenburg Research

Regulatory bodies around the world have taken notice of Hindenburg Research's activities. While some have praised the firm for its efforts in promoting transparency, others have expressed concerns about potential market manipulation. Regulatory responses have varied, with some agencies launching investigations based on Hindenburg's findings while others have questioned the firm's methodologies.

Future Outlook for Hindenburg Research

Looking ahead, Hindenburg Research is poised to continue its mission of exposing corporate fraud. With advancements in technology and data analytics, the firm is likely to enhance its investigative capabilities. However, the firm will need to navigate the challenges posed by regulatory scrutiny and potential legal action from targeted companies.

Conclusion and Takeaways

Nate Anderson Hindenburg Research has undeniably left a significant mark on the financial world. By exposing corporate malfeasance, the firm has contributed to greater transparency and accountability in global markets. However, the controversies surrounding its methods highlight the need for a balanced approach in investigative journalism.

We invite you to share your thoughts and opinions on Nate Anderson Hindenburg Research in the comments section below. Additionally, feel free to explore other articles on our site for more insights into the world of finance and corporate governance. Together, let's continue the conversation and strive for a more transparent and ethical financial landscape.

References:

- SEC Reports

- Financial Times

- Wall Street Journal