When it comes to credit cards, the TJX Credit Card has emerged as a powerful financial tool for savvy shoppers. It offers exclusive perks, discounts, and rewards tailored specifically for TJX retail brands such as TJ Maxx, Marshalls, and HomeGoods. Whether you're a frequent shopper or simply looking to maximize your spending potential, understanding the ins and outs of this credit card is crucial.

The TJX Credit Card is designed to enhance the shopping experience by providing cardholders with access to exclusive promotions, early access to sales, and cashback rewards. These features make it an attractive option for anyone who regularly shops at TJX stores. As we delve deeper into this article, you'll discover how this card can help you save money while enjoying the convenience of modern credit card features.

Before diving into the specifics, it's important to understand the broader context of credit cards in today's financial landscape. Credit cards are no longer just a means of payment; they have evolved into sophisticated financial instruments that offer a range of benefits. The TJX Credit Card stands out in this space by combining retail-focused rewards with responsible credit management tools, making it a compelling choice for consumers.

Read also:Jamey Johnsons Wife Who Is She

Table of Contents

- TJX Credit Card Overview

- Eligibility Requirements

- Key Benefits of the TJX Credit Card

- Rewards Program Details

- Fees and Charges

- How to Apply for the TJX Credit Card

- Tips for Maximizing Your Card Usage

- Comparison with Other Retail Credit Cards

- Security Features and Fraud Protection

- Frequently Asked Questions

TJX Credit Card Overview

The TJX Credit Card is issued by Synchrony Bank and is specifically designed for customers who frequently shop at TJX retail stores. It offers a range of benefits that cater to the needs of modern consumers, including cashback rewards, special financing options, and access to exclusive promotions. This card is ideal for those who want to enhance their shopping experience while maintaining financial discipline.

Card Features at a Glance

- Exclusive discounts at TJX stores

- No annual fee

- 0% introductory APR on purchases for a limited time

- Cashback rewards on eligible purchases

- Access to special financing options for larger purchases

One of the standout features of the TJX Credit Card is its ability to provide cardholders with early access to sales events. This means you can take advantage of the best deals before the general public, ensuring you get the items you want at the lowest possible price.

Eligibility Requirements

To qualify for the TJX Credit Card, applicants must meet certain eligibility criteria. While the specific requirements may vary depending on individual circumstances, here are some general guidelines:

Key Eligibility Factors

- Age: Applicants must be at least 18 years old

- Credit History: A good credit score is preferred, but those with fair credit may still qualify

- Income: Demonstrating a stable source of income is essential

It's important to note that the approval process takes into account various factors, including credit utilization, existing debt, and payment history. Therefore, maintaining a healthy credit profile is crucial for increasing your chances of approval.

Key Benefits of the TJX Credit Card

The TJX Credit Card offers a wide array of benefits that make it an attractive option for both casual and frequent shoppers. Let's explore some of the most significant advantages:

Exclusive Discounts and Promotions

Cardholders enjoy exclusive discounts and promotions at TJX stores, which can result in significant savings over time. These offers are often available throughout the year, ensuring you never miss out on a great deal.

Read also:Tamil Blasters News Updates 1tamilblastersin

Cashback Rewards

One of the most appealing features of the TJX Credit Card is its cashback rewards program. Cardholders earn rewards on eligible purchases, which can be redeemed for statement credits or gift cards. This allows you to effectively "earn back" a portion of your spending, making your purchases more cost-effective.

Rewards Program Details

The rewards program for the TJX Credit Card is designed to reward loyal shoppers with tangible benefits. Here's a breakdown of how the program works:

Reward Structure

- Earn 1 point per dollar spent on eligible purchases

- Redeem points for statement credits or gift cards

- No expiration date on earned rewards

Additionally, cardholders can take advantage of bonus rewards during specific promotional periods. These promotions often offer increased points on certain categories of purchases, providing even more value for your spending.

Fees and Charges

Understanding the fees associated with the TJX Credit Card is essential for making an informed decision. While the card does not have an annual fee, there are other charges to be aware of:

Common Fees

- Interest Rates: Variable APR based on creditworthiness

- Late Payment Fee: Up to $40 for late payments

- Cash Advance Fee: Either $10 or 5% of the transaction amount, whichever is greater

It's important to manage your account responsibly to avoid unnecessary fees. This includes making timely payments and avoiding cash advances unless absolutely necessary.

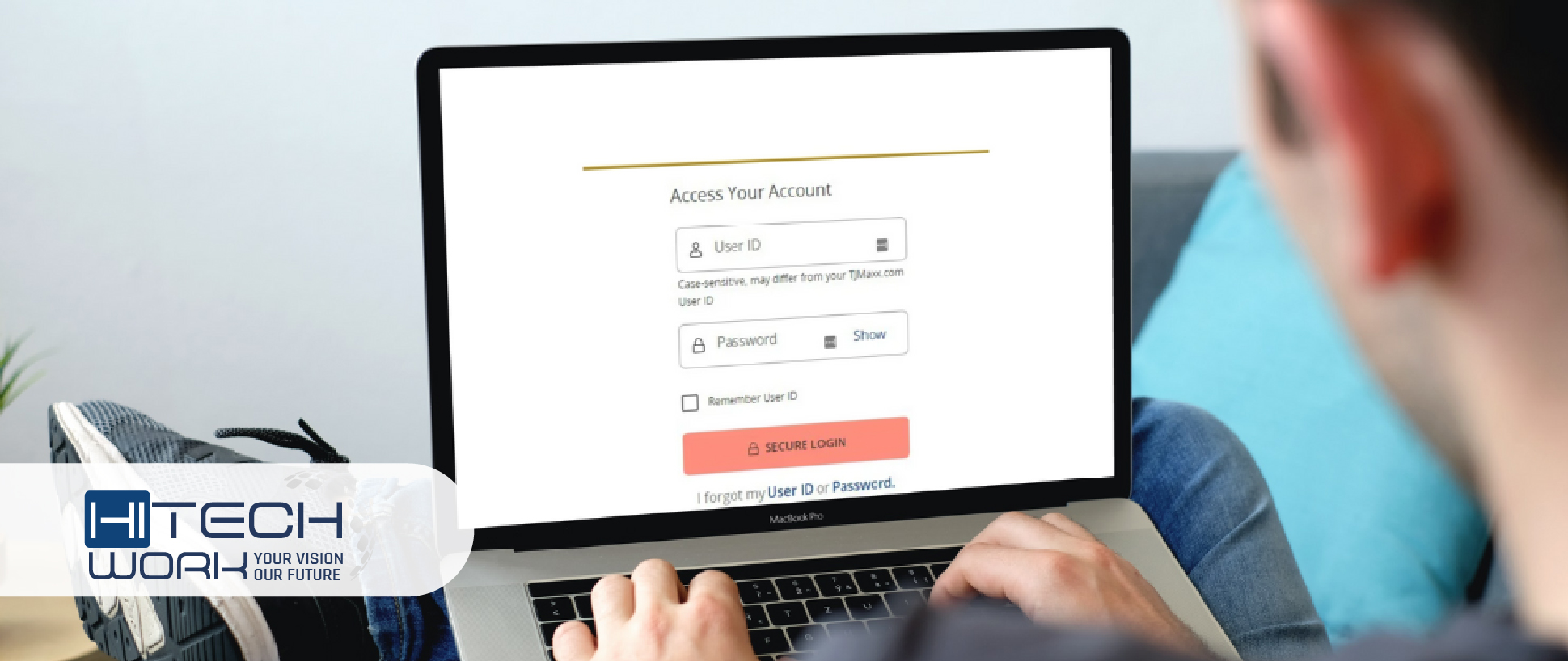

How to Apply for the TJX Credit Card

Applying for the TJX Credit Card is a straightforward process that can be completed online or in-store. Here's a step-by-step guide to help you through the application:

Online Application

- Visit the official TJX Credit Card website

- Fill out the application form with your personal and financial information

- Submit the application and receive an instant decision

In-Store Application

- Visit your nearest TJX store

- Speak to a customer service representative about applying for the card

- Complete the application process and receive your decision on-site

Whether you choose to apply online or in-store, the process is designed to be quick and convenient, allowing you to start enjoying the benefits of the card as soon as possible.

Tips for Maximizing Your Card Usage

To get the most out of your TJX Credit Card, consider the following tips:

Optimize Your Rewards

- Make all eligible purchases using your card to maximize rewards accumulation

- Take advantage of bonus rewards periods to earn additional points

- Redeem rewards regularly to avoid missing out on potential savings

Stay Financially Responsible

- Pay your balance in full each month to avoid interest charges

- Monitor your account for any unauthorized transactions

- Set up automatic payments to ensure timely bill payments

By following these tips, you can enjoy the benefits of the TJX Credit Card while maintaining a healthy financial profile.

Comparison with Other Retail Credit Cards

When evaluating the TJX Credit Card, it's helpful to compare it with other retail credit cards on the market. Here's a brief comparison:

TJX Credit Card vs. Competitors

| Feature | TJX Credit Card | Competitor Card |

|---|---|---|

| Annual Fee | No fee | $50 annual fee |

| Introductory APR | 0% for 6 months | 0% for 12 months |

| Rewards Program | Cashback rewards | Points-based rewards |

While the TJX Credit Card may not offer the longest introductory APR period, its no-fee structure and cashback rewards make it a strong contender in the retail credit card market.

Security Features and Fraud Protection

Security is a top priority for the TJX Credit Card. Cardholders benefit from a range of security features designed to protect against fraud and unauthorized transactions:

Key Security Features

- 24/7 fraud monitoring

- Zero liability protection for unauthorized charges

- Mobile app for real-time transaction alerts

These features provide peace of mind, ensuring that your financial information remains secure while using the card.

Frequently Asked Questions

Q: Can I use the TJX Credit Card at non-TJX stores?

A: While the TJX Credit Card is primarily designed for use at TJX stores, it can also be used at other retailers. However, rewards and promotions are typically limited to TJX locations.

Q: Is there a limit on how many rewards I can earn?

A: There is no cap on the number of rewards you can earn with the TJX Credit Card. As long as you make eligible purchases, you will continue to accumulate points.

Q: How long does it take to receive my card after approval?

A: If approved, you can expect to receive your physical card in the mail within 7-10 business days. In the meantime, you can start using your card immediately through the mobile app.

Conclusion

The TJX Credit Card offers a compelling combination of benefits, rewards, and security features that make it an excellent choice for shoppers who frequent TJX stores. By understanding the card's features and using it responsibly, you can take advantage of exclusive discounts, cashback rewards, and special financing options.

We encourage you to apply for the TJX Credit Card today and start enjoying the many benefits it has to offer. Don't forget to share your experience with us in the comments below, and explore other articles on our site for more financial tips and insights.