Managing your finances effectively is crucial, and understanding how JCPenney credit card payment works can significantly help you maintain financial stability. Whether you're a first-time user or a seasoned shopper, knowing the ins and outs of JCPenney credit card payment options can simplify your financial life. This guide will provide you with detailed insights into the various payment methods, benefits, and strategies to optimize your credit card usage.

JCPenney credit card payment is more than just a transaction; it's a tool that empowers you to take control of your spending and rewards you for loyalty. From understanding the payment process to exploring the various features of the JCPenney credit card, this article will equip you with the knowledge you need to make informed decisions.

This article will delve into the intricacies of JCPenney credit card payment, offering expert advice and actionable tips. By the end of this guide, you'll have a clear understanding of how to manage your JCPenney credit card effectively, ensuring that you maximize the benefits while minimizing potential pitfalls.

Read also:Best Hindi Movie Downloads Free Legal

Table of Contents

- Introduction to JCPenney Credit Card

- JCPenney Credit Card Payment Process

- Benefits of JCPenney Credit Card

- Managing JCPenney Credit Card Online

- Payment Options for JCPenney Credit Card

- Avoiding Common Credit Card Pitfalls

- Frequently Asked Questions

- Expert Tips for Financial Management

- Sources and References

- Conclusion and Call to Action

Introduction to JCPenney Credit Card

JCPenney offers a range of credit card options designed to cater to the diverse needs of its customers. Whether you're shopping for clothing, home decor, or electronics, the JCPenney credit card provides a convenient way to make purchases while enjoying exclusive benefits.

Types of JCPenney Credit Cards

JCPenney offers two main types of credit cards: the JCPenney Visa® Credit Card and the JCPenney Store Credit Card. Each card comes with its own set of features and benefits, tailored to different shopping preferences.

- JCPenney Visa® Credit Card: This card can be used anywhere Visa is accepted, offering greater flexibility and convenience.

- JCPenney Store Credit Card: This card is specifically designed for use at JCPenney stores, providing exclusive discounts and rewards for loyal customers.

JCPenney Credit Card Payment Process

Making a JCPenney credit card payment is a straightforward process that can be done in various ways, depending on your preference. Understanding the payment process ensures that you stay on top of your financial obligations.

Steps to Make a Payment

To make a payment on your JCPenney credit card, follow these simple steps:

- Log in to your JCPenney account online or via the mobile app.

- Select the "Make a Payment" option.

- Choose the payment method you wish to use, such as bank transfer or debit card.

- Enter the payment amount and confirm the transaction.

Benefits of JCPenney Credit Card

Using a JCPenney credit card comes with numerous advantages that go beyond just convenience. Here are some of the key benefits:

Exclusive Discounts

JCPenney credit card holders enjoy exclusive discounts on select items, helping them save money on their purchases. These discounts are often available during special promotions or sales events.

Read also:Exclusive Onlyfans Leaks Exposed

Rewards Program

The JCPenney credit card rewards program allows customers to earn points for every dollar spent. These points can be redeemed for discounts on future purchases, providing additional value to cardholders.

Managing JCPenney Credit Card Online

In today's digital age, managing your JCPenney credit card online is both convenient and efficient. With just a few clicks, you can access your account, view transaction history, and make payments.

Setting Up Your Online Account

To manage your JCPenney credit card online, you'll need to set up an account by providing some basic information, such as your card number and personal details. Once your account is activated, you can enjoy the benefits of online management.

Payment Options for JCPenney Credit Card

JCPenney offers multiple payment options to suit the preferences of its customers. Whether you prefer online payments, phone payments, or in-store payments, JCPenney has you covered.

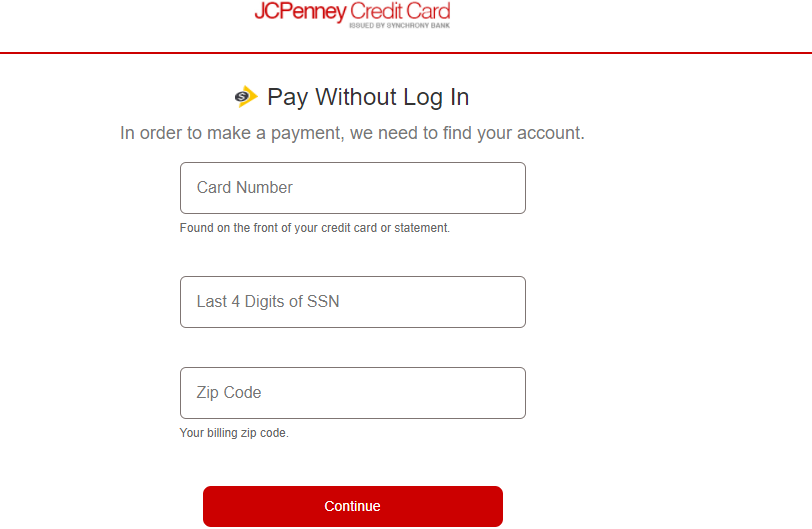

Online Payments

Online payments are the most convenient option, allowing you to make payments anytime, anywhere. Simply log in to your account and follow the prompts to complete the transaction.

Phone Payments

If you prefer speaking to a representative, you can make payments over the phone by calling the JCPenney customer service number. This option is ideal for those who need assistance with their payment process.

Avoiding Common Credit Card Pitfalls

While credit cards offer many benefits, they can also lead to financial pitfalls if not managed properly. Here are some common mistakes to avoid:

Carrying a Balance

Carrying a balance on your credit card can result in accumulating interest charges, making it more difficult to pay off your debt. It's best to pay off your balance in full each month to avoid unnecessary expenses.

Missing Payments

Missing payments can negatively impact your credit score and result in late fees. Setting up automatic payments or reminders can help you stay on track and avoid these penalties.

Frequently Asked Questions

Here are some common questions about JCPenney credit card payment:

Can I use my JCPenney credit card at other stores?

Yes, if you have the JCPenney Visa® Credit Card, you can use it at any store that accepts Visa. The JCPenney Store Credit Card, however, is only valid at JCPenney locations.

What happens if I miss a payment?

If you miss a payment, you may incur late fees and your credit score could be negatively affected. It's important to make payments on time to maintain a good credit standing.

Expert Tips for Financial Management

Managing your finances effectively requires discipline and strategy. Here are some expert tips to help you manage your JCPenney credit card:

Create a Budget

Creating a budget is essential for managing your finances. By tracking your income and expenses, you can ensure that you have enough money to cover your credit card payments and other financial obligations.

Monitor Your Credit Score

Your credit score plays a crucial role in your financial health. Regularly monitoring your credit score can help you identify areas for improvement and ensure that you maintain a good credit standing.

Sources and References

This article draws on information from reputable sources, including:

Conclusion and Call to Action

In conclusion, understanding how to manage your JCPenney credit card payment is vital for maintaining financial stability. By following the tips and strategies outlined in this guide, you can make the most of your credit card while avoiding common pitfalls.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into personal finance and credit management. Together, let's take control of our financial futures!