In today's fast-paced world, financial planning has become more crucial than ever. MyKPlan emerges as a powerful tool designed to help individuals take control of their finances and achieve their financial goals efficiently. Whether you're just starting your financial journey or looking to refine your existing strategies, MyKPlan offers a range of features tailored to meet diverse needs. In this comprehensive guide, we will explore everything you need to know about MyKPlan and how it can transform your financial life.

Managing finances can be overwhelming, especially with the myriad of options available in the market. MyKPlan simplifies this process by providing a user-friendly platform that caters to both beginners and seasoned investors. By leveraging advanced technology, it ensures that users can make informed decisions about their money.

This article will delve into the features, benefits, and practical applications of MyKPlan. We'll also cover how this platform aligns with modern financial practices and supports long-term wealth creation. Let's get started!

Read also:Boris Sanchez Wife Meet The Woman Behind The Star

Table of Contents

- What is MyKPlan?

- Key Features of MyKPlan

- Benefits of Using MyKPlan

- How MyKPlan Works

- Who Can Use MyKPlan?

- Pricing Plans

- Security Measures in MyKPlan

- Customer Support

- Expert Reviews and Testimonials

- Conclusion and Call to Action

What is MyKPlan?

MyKPlan is a cutting-edge financial planning platform designed to empower individuals in managing their finances effectively. It offers a comprehensive suite of tools that cater to various financial needs, from budgeting and saving to investment tracking and retirement planning. With MyKPlan, users can gain a holistic view of their financial health and make data-driven decisions.

History of MyKPlan

Launched in 2015, MyKPlan quickly gained traction due to its innovative approach to personal finance management. The platform was developed by a team of financial experts and tech professionals who recognized the need for a more accessible and intuitive financial planning tool. Over the years, MyKPlan has evolved to include advanced features that cater to the changing financial landscape.

Core Mission

The core mission of MyKPlan is to democratize financial planning by making it accessible to everyone, regardless of their financial background. By offering a range of customizable features, the platform ensures that users can tailor their financial strategies to suit their unique goals and circumstances.

Key Features of MyKPlan

MyKPlan boasts an array of features that make it a standout choice for financial planning. Below are some of the key features:

Comprehensive Dashboard

- A single dashboard that consolidates all financial accounts, providing a clear overview of your financial status.

- Real-time updates on account balances and transaction histories.

Budgeting Tools

- Advanced budgeting tools that help users allocate their income effectively.

- Customizable categories for expenses, allowing for detailed tracking.

Investment Tracking

- Track the performance of your investments across multiple platforms.

- Receive alerts on market trends and investment opportunities.

Benefits of Using MyKPlan

Using MyKPlan offers numerous benefits that contribute to achieving financial stability and growth. Here are some of the key advantages:

Enhanced Financial Awareness

By providing a detailed view of your financial situation, MyKPlan helps users become more aware of their spending habits and areas for improvement.

Read also:Best Boly4u Deals Offers

Increased Savings

With its budgeting tools, MyKPlan enables users to identify opportunities to save money and allocate funds more efficiently.

Improved Investment Decisions

Through its investment tracking feature, MyKPlan empowers users to make informed decisions about their investments, leading to better returns.

How MyKPlan Works

MyKPlan operates on a user-friendly interface that simplifies the financial planning process. Here's how it works:

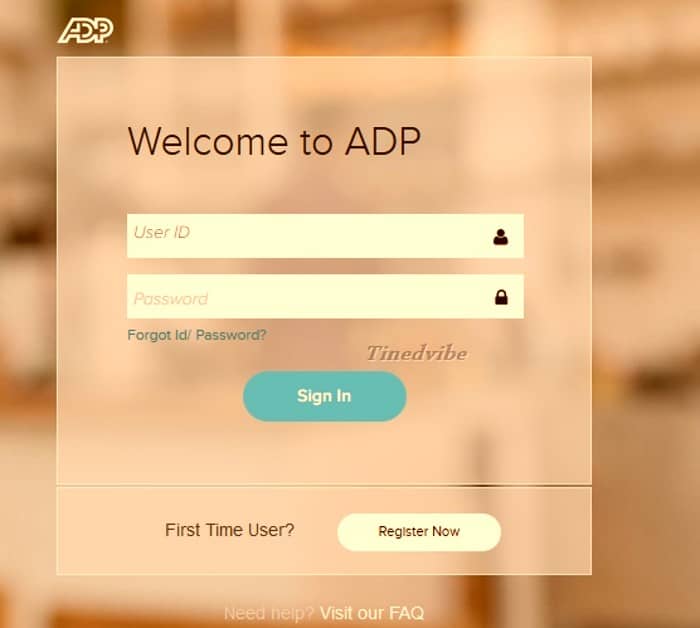

Account Setup

Upon signing up, users are guided through a straightforward setup process where they connect their financial accounts to the platform.

Customization

Users can customize their dashboard and settings to reflect their financial goals and preferences, ensuring a personalized experience.

Regular Updates

The platform provides regular updates on financial performance, helping users stay informed and make timely adjustments to their plans.

Who Can Use MyKPlan?

MyKPlan is designed for a wide range of users, including:

- Individuals seeking to improve their financial literacy and planning skills.

- Small business owners looking to manage their finances more effectively.

- Investors who want to track and optimize their investment portfolios.

Regardless of your financial background, MyKPlan offers tools and resources that can benefit you.

Pricing Plans

MyKPlan offers flexible pricing plans to accommodate different user needs:

- Basic Plan: Free access to essential features, ideal for beginners.

- Premium Plan: $9.99/month, includes advanced features and priority support.

- Pro Plan: $19.99/month, designed for power users with extensive financial needs.

Each plan is tailored to provide value at every level, ensuring that users get the most out of their subscription.

Security Measures in MyKPlan

Security is a top priority for MyKPlan, and the platform employs several measures to protect user data:

Data Encryption

All user data is encrypted using industry-standard protocols to ensure confidentiality and integrity.

Two-Factor Authentication

Users can enable two-factor authentication for an added layer of security when accessing their accounts.

Regular Audits

The platform undergoes regular security audits to identify and address potential vulnerabilities.

Customer Support

MyKPlan offers excellent customer support to assist users with any issues or inquiries:

- 24/7 live chat support for immediate assistance.

- Comprehensive FAQ section addressing common questions.

- Personalized support for premium and pro users.

With its robust support system, MyKPlan ensures that users have a seamless experience.

Expert Reviews and Testimonials

MyKPlan has received positive reviews from financial experts and satisfied users alike:

- According to a report by Forbes, MyKPlan is one of the top financial planning platforms for 2023.

- Users have praised its intuitive interface and comprehensive features, with many noting significant improvements in their financial management.

These reviews highlight the platform's effectiveness and reliability in helping users achieve their financial goals.

Conclusion and Call to Action

In conclusion, MyKPlan is a powerful tool that can revolutionize the way you manage your finances. By offering a range of features and benefits, it empowers users to take control of their financial futures. Whether you're a beginner or an experienced investor, MyKPlan has something to offer you.

We encourage you to try MyKPlan today and experience the difference it can make in your financial life. Leave a comment below to share your thoughts or questions, and don't forget to explore our other articles for more insights on personal finance.