Managing finances effectively requires a clear understanding of payment schedules, and USA pay dates play a crucial role in this process. Whether you're an employee, contractor, or freelancer, knowing when your payments will arrive is essential for budgeting and financial planning. In this article, we'll explore everything you need to know about USA pay dates, including how they work, common payment schedules, and tips for staying organized.

Financial stability starts with understanding the ins and outs of your income. From bi-weekly paychecks to monthly payments, having a grasp of when money will hit your account can help you avoid unnecessary stress and make smarter financial decisions.

This guide is designed to provide valuable insights into USA pay dates, ensuring you're equipped with the knowledge to manage your finances confidently. Let's dive in and explore the details!

Read also:Leaked Mms Video Shocking Details Revealed

Table of Contents

- What Are USA Pay Dates?

- Common Pay Schedules in the USA

- Bi-Weekly Pay Schedule

- Semi-Monthly Pay Schedule

- Monthly Pay Schedule

- Factors Affecting Pay Dates

- Government Pay Dates

- Tips for Managing Pay Dates

- Common Questions About Pay Dates

- Conclusion

What Are USA Pay Dates?

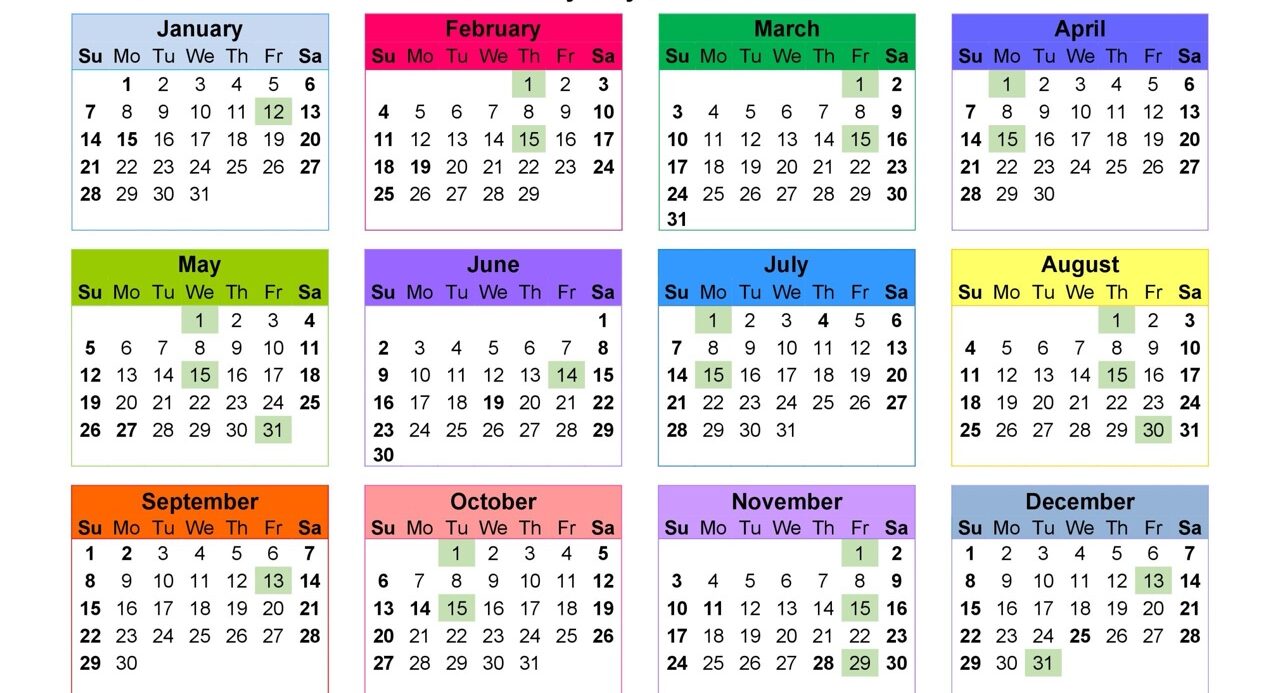

USA pay dates refer to the specific days when employees or contractors receive their earnings. These dates are determined by employers and often follow a set schedule, such as bi-weekly, semi-monthly, or monthly. Understanding your pay schedule is crucial for managing expenses, saving money, and planning for the future.

In the United States, pay schedules can vary significantly depending on the industry, company size, and employment type. Some companies may offer direct deposit, while others may issue paper checks. Regardless of the method, knowing when to expect your payment helps ensure financial stability.

For example, if you're paid bi-weekly, you'll receive a paycheck every two weeks, resulting in 26 paychecks per year. On the other hand, a semi-monthly schedule means you'll receive payments twice a month, typically on the 15th and the last day of the month.

Common Pay Schedules in the USA

Employers in the USA typically follow one of three primary pay schedules: bi-weekly, semi-monthly, or monthly. Each schedule has its own advantages and disadvantages, and understanding them can help you better manage your finances.

Bi-Weekley Pay Schedule

A bi-weekly pay schedule involves receiving payments every two weeks, resulting in 26 paychecks annually. This is one of the most common pay schedules in the USA and is often preferred by employees because it provides consistent and frequent income.

Semi-Monthly Pay Schedule

Semi-monthly pay schedules involve receiving payments twice a month, usually on the 15th and the last day of the month. This schedule results in 24 paychecks per year and is often used by companies that prefer a more structured payment system.

Read also:Mika Lafuente Leaks Shocking Details Revealed

Monthly Pay Schedule

A monthly pay schedule involves receiving one payment per month, typically on the last business day. While less common, this schedule is still used by some employers, particularly in certain industries like academia or government.

Bi-Weekly Pay Schedule: Benefits and Considerations

Bi-weekly pay schedules are popular among employers and employees alike due to their consistency and frequency. Here are some key benefits and considerations:

- Consistency: Employees receive payments every two weeks, making it easier to budget and plan expenses.

- Frequency: With 26 paychecks per year, employees have more opportunities to manage their finances effectively.

- Tax Implications: Employers calculate taxes based on each paycheck, which can result in slightly lower withholdings compared to semi-monthly or monthly schedules.

However, there are some considerations to keep in mind. For example, some months may have three paychecks instead of two, which can affect budgeting and financial planning.

Semi-Monthly Pay Schedule: Structure and Advantages

Semi-monthly pay schedules offer a structured approach to payment, with employees receiving checks on specific dates twice a month. Here's a closer look at the advantages:

- Predictability: Payments are made on fixed dates, such as the 15th and the last day of the month, making it easier to plan expenses.

- Tax Calculations: Employers calculate taxes based on 24 pay periods, which can simplify payroll processing.

- Employee Preference: Some employees prefer the predictability of semi-monthly payments, especially those with fixed monthly expenses.

While semi-monthly schedules offer structure, they may not provide the same frequency as bi-weekly schedules, which can impact short-term financial planning.

Monthly Pay Schedule: Less Common but Still Relevant

A monthly pay schedule involves receiving one payment per month, typically on the last business day. While less common, this schedule is still used in certain industries, such as academia and government. Here are some key points to consider:

- Reduced Paychecks: With only 12 payments per year, employees must carefully manage their finances to cover expenses between paychecks.

- Simplified Tax Calculations: Employers calculate taxes based on 12 pay periods, which can streamline payroll processing.

- Industry-Specific Use: Monthly schedules are often used in industries where employees have predictable and stable income, such as professors or government workers.

While monthly schedules may not suit everyone, they can be advantageous for those with stable and predictable income sources.

Factors Affecting Pay Dates

Several factors can influence when you receive your paycheck, even if your employer follows a set schedule. These factors include:

- Holidays: Paychecks may be issued early if the scheduled pay date falls on a holiday.

- Weekends: Payments are often processed on the preceding Friday if the scheduled date falls on a weekend.

- Payroll Processing: Delays in payroll processing can sometimes impact when payments are issued.

- Direct Deposit: Employees using direct deposit may receive payments earlier than those receiving paper checks.

Understanding these factors can help you anticipate any changes to your payment schedule and plan accordingly.

Government Pay Dates: How They Work

Government employees often follow a semi-monthly pay schedule, with payments issued on specific dates each month. Here's a breakdown of how government pay dates work:

- Fixed Dates: Payments are typically issued on the 15th and the last day of the month.

- Direct Deposit: Most government employees use direct deposit, ensuring timely and secure payment delivery.

- Holiday Adjustments: If a pay date falls on a holiday, payments may be issued on the preceding business day.

Government pay schedules are designed to provide stability and predictability, helping employees manage their finances effectively.

Tips for Managing Pay Dates

Effectively managing your pay dates is essential for maintaining financial stability. Here are some practical tips to help you stay organized:

- Create a Budget: Plan your expenses based on your pay schedule to ensure you're living within your means.

- Automate Savings: Set up automatic transfers to your savings account to build a financial cushion.

- Track Expenses: Use budgeting apps or spreadsheets to monitor your spending and adjust as needed.

- Prepare for Variations: Be prepared for months with extra paychecks or delayed payments by maintaining an emergency fund.

By implementing these strategies, you can take control of your finances and reduce stress related to payment schedules.

Common Questions About Pay Dates

Here are some frequently asked questions about USA pay dates:

- How often do employees get paid in the USA? Pay frequency varies by employer, with common schedules including bi-weekly, semi-monthly, and monthly.

- What happens if my pay date falls on a holiday? Payments are typically issued on the preceding business day to ensure timely delivery.

- Can I change my pay schedule? Pay schedules are determined by employers, but you can request changes if your employer offers flexible options.

Understanding these FAQs can help clarify any confusion about pay schedules and ensure you're prepared for any changes.

Conclusion

In conclusion, understanding USA pay dates is essential for effective financial management. Whether you're on a bi-weekly, semi-monthly, or monthly pay schedule, knowing when to expect your payments can help you plan expenses, save money, and achieve financial stability.

We encourage you to take action by creating a budget, automating savings, and tracking your expenses. Share this article with others who may benefit from the information, and feel free to leave a comment with any questions or insights. Together, let's build a stronger financial future!