Are you scratching your head trying to figure out how NC state refund works? Well, you’re not alone. Many folks find themselves in the same boat when tax season rolls around. Whether you’re a seasoned taxpayer or a first-timer, understanding the ins and outs of refunds in North Carolina can save you a lot of headaches—and maybe even a few bucks! So, let’s dive right into it and break it all down for you.

When it comes to NC state refund, there’s a lot more to it than just filing your taxes and waiting for a check to show up in the mail or hitting your bank account. You’ve got to know the rules, the deadlines, and the potential pitfalls. And trust me, there are plenty of them. But don’t worry, we’ve got your back. This guide is all about making sure you get every penny you’re entitled to.

Now, before we get too deep into the nitty-gritty, let’s quickly go over why this is such a big deal. Your NC state refund isn’t just some random number the government spits out. It’s actually your money that you’ve earned and paid in taxes throughout the year. The goal here is to make sure you’re not leaving any cash on the table because, let’s face it, who doesn’t love a little extra cash, right?

Read also:Jules Arii Latest Hits Music Videos

What Exactly is an NC State Refund?

Alright, so let’s start with the basics. An NC state refund is essentially the state of North Carolina returning any excess taxes that you’ve paid during the year. Think of it like this: you pay your taxes throughout the year, but if you end up paying more than what you owe, the state owes you back. And that’s where the refund comes in.

Now, there are a few key factors that determine how much you’ll get back. Things like your income level, deductions, and credits all play a role. But here’s the kicker—it’s not always as straightforward as it seems. Sometimes, people end up paying too much because they don’t claim all the deductions and credits they’re eligible for. That’s why it’s crucial to understand the process inside and out.

Who Can Get an NC State Refund?

Here’s the good news—pretty much anyone who pays state taxes in North Carolina is eligible for a refund. But there are a few caveats. First off, you’ve got to file your taxes. If you don’t file, you’re not going to get anything back. Simple as that. Secondly, you’ve got to make sure you’re claiming all the deductions and credits you’re entitled to. That’s where a lot of people slip up.

For example, if you’re a homeowner, you might be eligible for a homestead exemption. Or if you’ve got kids, you could qualify for child tax credits. The list goes on, and it’s important to do your research or consult with a tax professional to make sure you’re not missing out on anything.

When Should You Expect Your NC State Refund?

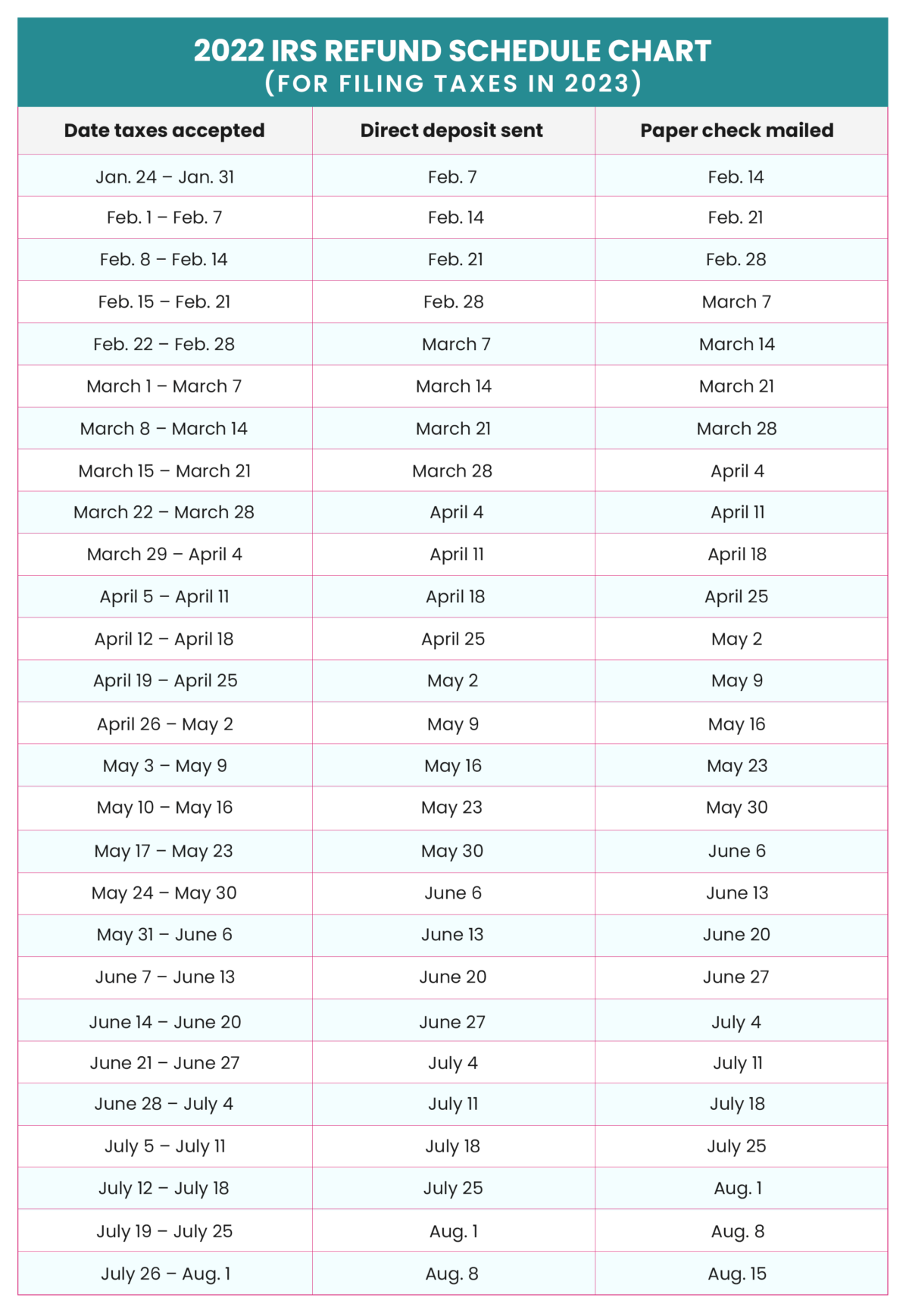

This is probably one of the most common questions people have about NC state refunds. The truth is, the timeline can vary depending on a few factors. If you file electronically and opt for direct deposit, you could see your refund in as little as two to three weeks. But if you file a paper return or request a paper check, it could take up to eight weeks or longer.

Another thing to keep in mind is that the North Carolina Department of Revenue processes refunds on a first-come, first-served basis. So, the earlier you file, the quicker you’ll get your money. Plus, filing early can also help protect you from identity theft, which is a growing concern these days.

Read also:Latest Kannada Movies 2024 Download On Movierulz

How to File for Your NC State Refund

Filing for your NC state refund doesn’t have to be a headache if you know what you’re doing. The easiest and fastest way is to file electronically using tax software or a tax professional. Most of these platforms will walk you through the process step-by-step, making it super simple even for beginners.

Here’s a quick rundown of what you’ll need to file:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your W-2 forms from all your employers

- Any 1099 forms if you have investment income or freelance work

- Records of deductions and credits you plan to claim

- Your bank account information for direct deposit

Once you’ve got all your ducks in a row, filing is just a matter of filling out the forms and hitting submit. Easy peasy, right?

Common Mistakes to Avoid When Filing for an NC State Refund

Even the most careful filers can make mistakes when it comes to taxes. And those mistakes can end up costing you big time. Here are a few common pitfalls to watch out for:

- Forgetting to claim all your deductions and credits

- Entering incorrect information, like Social Security numbers or bank account details

- Missing the filing deadline

- Not double-checking your math

- Not keeping copies of your tax returns for your records

Trust me, taking the time to double-check everything can save you a lot of hassle down the road. And if you’re ever in doubt, it’s always a good idea to consult with a tax professional.

Understanding Deductions and Credits for NC State Refunds

Alright, so let’s talk about deductions and credits. These are basically ways to reduce the amount of taxes you owe, which can lead to a bigger refund. Deductions lower your taxable income, while credits directly reduce the amount of tax you owe.

Some common deductions for NC state refunds include:

- Mortgage interest

- Charitable donations

- Student loan interest

- Medical expenses

As for credits, here are a few you might qualify for:

- Child tax credit

- Earned Income Tax Credit (EITC)

- Education credits

- Energy-efficient home improvements

Again, it’s important to do your research or consult with a tax professional to make sure you’re claiming everything you’re entitled to.

What Happens if You Don’t Get Your NC State Refund?

If you’ve filed your taxes and you’re still waiting on your refund, don’t panic just yet. There could be a few reasons why it’s taking longer than expected. Maybe there was an error in your return, or maybe the IRS or North Carolina Department of Revenue needs more information from you.

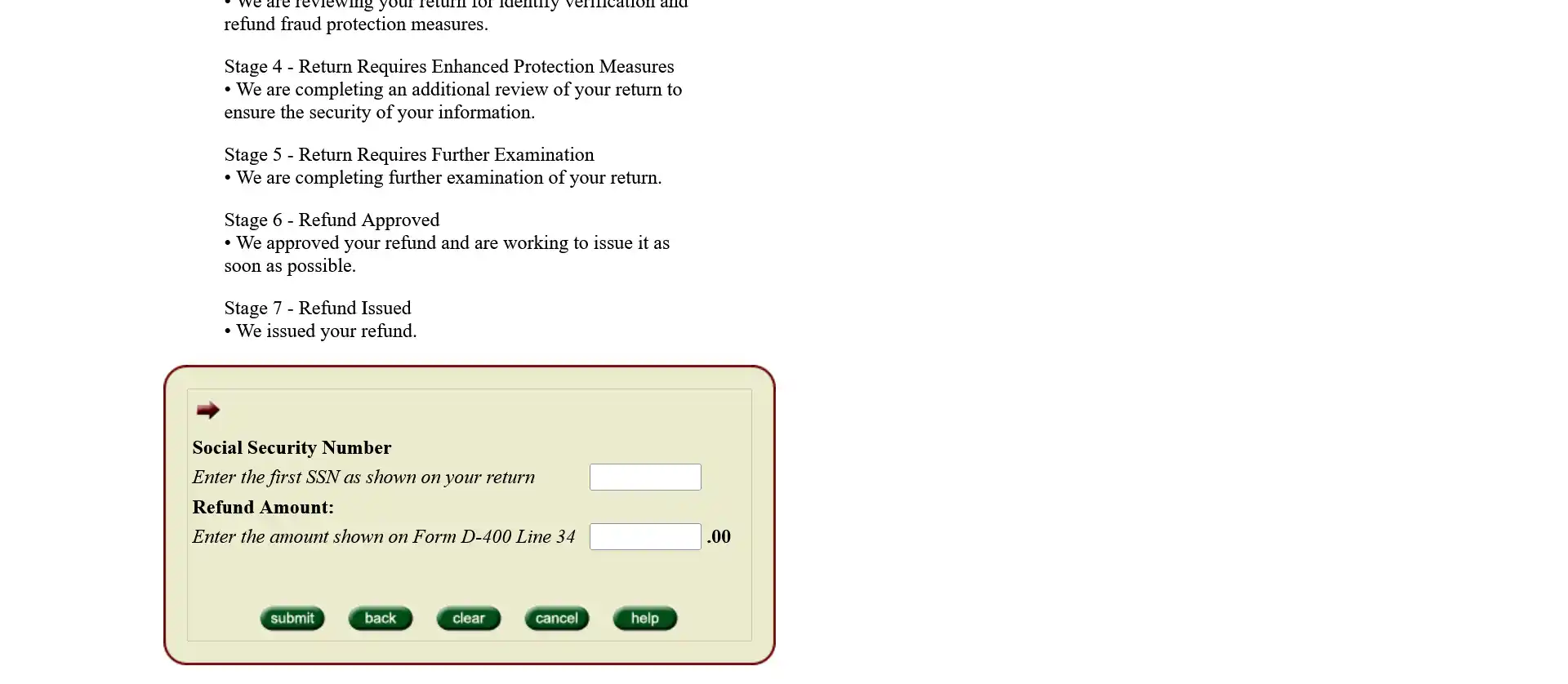

The best thing to do is check the status of your refund online using the tools provided by the North Carolina Department of Revenue. If everything checks out and you’re still not getting your refund, you might need to reach out to them directly for assistance.

Tips for Checking Your Refund Status

Here are a few tips to help you check the status of your NC state refund:

- Use the online tools provided by the North Carolina Department of Revenue

- Have your Social Security number and tax filing information handy

- Wait at least 21 days after filing electronically or six weeks after mailing a paper return before checking

And if you still can’t figure it out, don’t hesitate to reach out to the North Carolina Department of Revenue for help. They’re there to assist you, after all.

How to Protect Yourself from Tax Refund Fraud

Unfortunately, tax refund fraud is a real problem these days. Scammers are always looking for ways to steal your identity and claim your refund before you do. But there are steps you can take to protect yourself:

- File your taxes as early as possible

- Use strong passwords and two-factor authentication for any accounts related to your taxes

- Be cautious of phishing scams and never give out personal information unless you’re sure it’s legitimate

- Monitor your credit reports regularly for any suspicious activity

By staying vigilant and taking these precautions, you can help ensure that your NC state refund ends up in your pocket where it belongs.

Conclusion: Maximizing Your NC State Refund

Well, there you have it—everything you need to know about NC state refunds. From understanding the basics to avoiding common mistakes and protecting yourself from fraud, this guide has got you covered. The key takeaway here is to make sure you’re claiming all the deductions and credits you’re entitled to and filing your taxes accurately and on time.

So, what are you waiting for? Go ahead and file your taxes today and start counting down the days until your refund arrives. And don’t forget to share this guide with your friends and family so they can get their hands on their refunds too!

Table of Contents

- NC State Refund: Your Ultimate Guide to Understanding and Maximizing Your Returns

- What Exactly is an NC State Refund?

- Who Can Get an NC State Refund?

- When Should You Expect Your NC State Refund?

- How to File for Your NC State Refund

- Common Mistakes to Avoid When Filing for an NC State Refund

- Understanding Deductions and Credits for NC State Refunds

- What Happens if You Don’t Get Your NC State Refund?

- How to Protect Yourself from Tax Refund Fraud

- Conclusion: Maximizing Your NC State Refund