In today's fast-paced financial world, understanding credit options is essential for managing personal finances effectively. Lowes Synchrony stands out as a valuable financial tool designed to help consumers save money while shopping for home improvement needs. With its unique benefits and features, the Lowes Synchrony credit card offers more than just a payment option—it's a strategic way to enhance your purchasing power.

The Lowes Synchrony credit card has become a go-to choice for homeowners and DIY enthusiasts. It provides exclusive benefits such as interest-free financing on select purchases, cashback rewards, and special discounts on Lowes products. This article aims to provide an in-depth exploration of the Lowes Synchrony card, helping you decide if it’s the right financial solution for your lifestyle.

Whether you're planning a home renovation or simply need to buy essential tools, understanding the Lowes Synchrony card's features is crucial. By the end of this guide, you’ll have a clear picture of how this card can enhance your financial strategy and simplify your home improvement endeavors.

Read also:Best Luxmoviesin Alternatives Streaming Sites

Table of Contents

- Introduction to Lowes Synchrony

- Key Benefits of Lowes Synchrony

- Eligibility Requirements

- Special Features

- Rewards Program

- No-Interest Financing

- Costs and Fees

- Comparison with Other Credit Cards

- Tips for Maximizing Benefits

- Conclusion and Final Thoughts

Introduction to Lowes Synchrony

Lowes Synchrony is a credit card tailored specifically for customers of Lowes, one of the largest home improvement retailers in the United States. This card is designed to offer financial flexibility and rewards to those who frequently shop at Lowes stores or online. By combining the convenience of a credit card with exclusive perks, Lowes Synchrony has become a popular choice among homeowners and contractors alike.

History of Lowes Synchrony

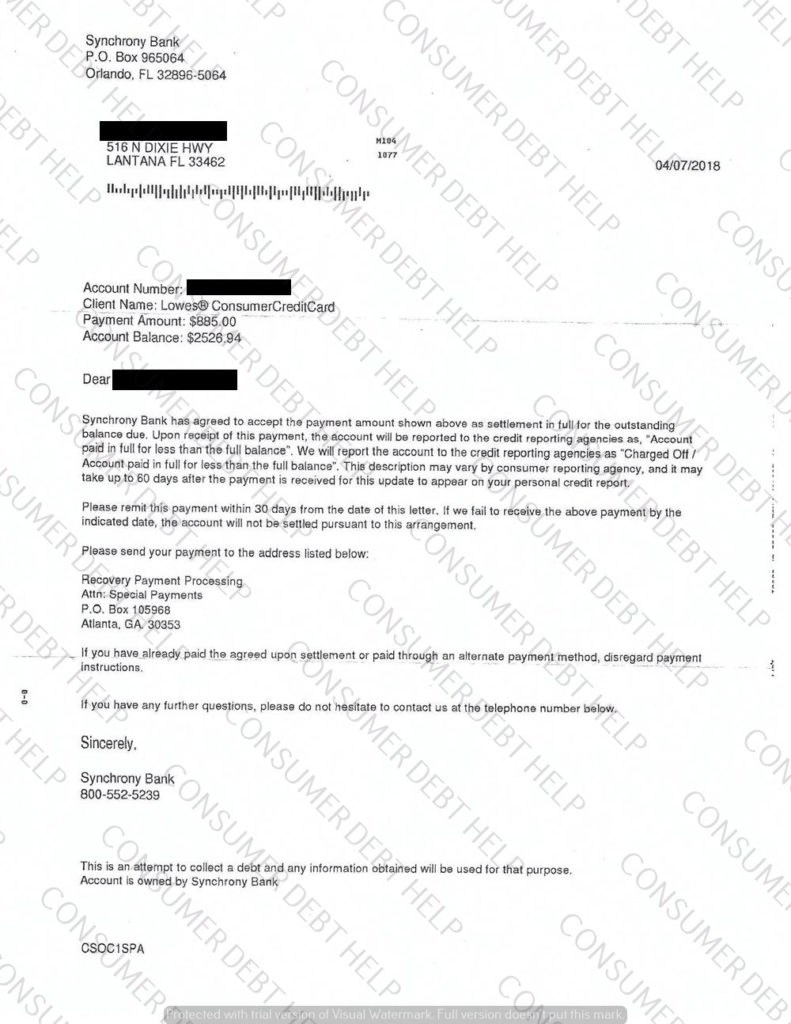

The partnership between Lowes and Synchrony Bank began with the aim of providing customers with a seamless shopping experience. Synchrony, a leading provider of consumer financial services, brings expertise in credit card management, ensuring that the Lowes Synchrony card offers competitive rates and benefits.

Why Choose Lowes Synchrony?

With a focus on home improvement, the Lowes Synchrony card caters to the specific needs of its users. Whether you're buying appliances, tools, or materials, the card offers tailored benefits that make it an attractive option for regular Lowes shoppers.

Key Benefits of Lowes Synchrony

The Lowes Synchrony card comes with a host of benefits that make it a valuable asset for anyone looking to enhance their home improvement projects. Below are some of the standout advantages:

- No-Interest Financing: Enjoy extended periods of interest-free financing on select purchases over a certain amount.

- Cashback Rewards: Earn cashback on purchases made at Lowes, providing a financial return on your spending.

- Exclusive Discounts: Access special discounts and promotions available only to Lowes Synchrony cardholders.

Additional Perks

Beyond the primary benefits, cardholders can enjoy:

- Special event invitations

- Priority access to sales

- Price protection guarantees

Eligibility Requirements

Before applying for the Lowes Synchrony card, it's important to understand the eligibility criteria. While the card is widely accessible, certain financial qualifications must be met to ensure approval.

Read also:Anjali Arora Mms Leaked Videos Latest News

Income and Credit Score

Applicants should have a stable income and a good credit score. While Synchrony Bank doesn't disclose exact score requirements, maintaining a credit score above 670 increases the likelihood of approval.

Age Requirement

Applicants must be at least 18 years old to qualify for the Lowes Synchrony card. For those under 21, additional documentation may be required to demonstrate financial stability.

Special Features

The Lowes Synchrony card stands out due to its innovative features designed to enhance user experience. Below are some of the most notable features:

No-Interest Financing

One of the card's most attractive features is its no-interest financing option. This allows cardholders to make large purchases without worrying about accruing interest during a specified promotional period.

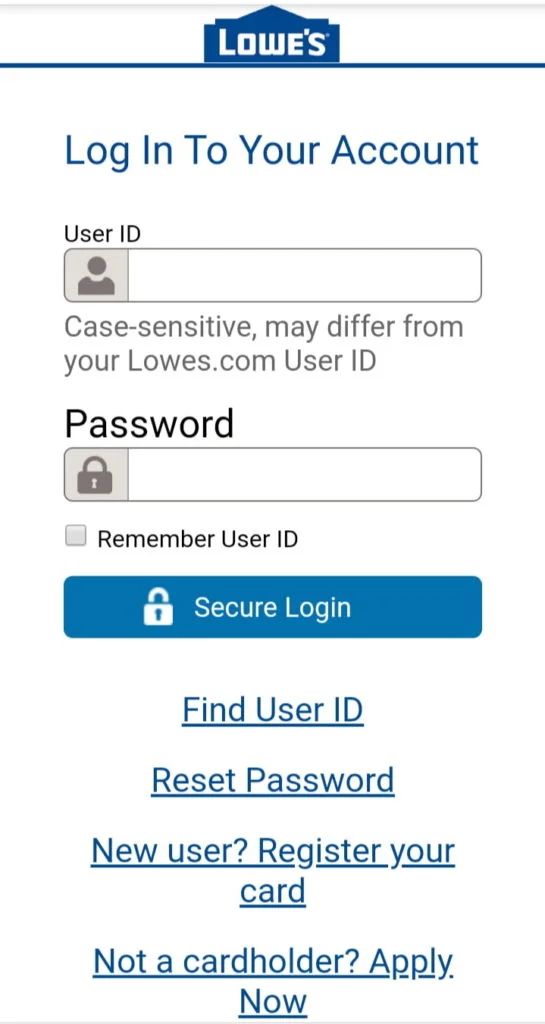

Mobile App Integration

The Lowes Synchrony card integrates seamlessly with the Lowes mobile app, providing users with easy access to account information, transaction history, and rewards tracking.

Rewards Program

The rewards program associated with the Lowes Synchrony card is designed to reward loyal customers. By earning points or cashback on purchases, cardholders can enjoy financial benefits that accumulate over time.

How the Rewards Work

Cardholders earn a percentage of cashback on all purchases made at Lowes. These rewards can then be redeemed for statement credits, gift cards, or other incentives.

No-Interest Financing

No-interest financing is a key feature of the Lowes Synchrony card, offering cardholders the ability to finance large purchases without incurring interest charges during the promotional period.

Eligible Purchases

Not all purchases qualify for no-interest financing. Typically, purchases over a certain dollar amount are eligible, and the promotional period varies depending on the offer.

Costs and Fees

While the Lowes Synchrony card offers numerous benefits, it's essential to be aware of potential costs and fees associated with the card.

Annual Fee

Currently, the Lowes Synchrony card does not have an annual fee, making it an affordable option for many users.

Interest Rates

After the promotional period, standard interest rates apply. It's crucial to understand these rates to avoid unexpected charges.

Comparison with Other Credit Cards

When comparing the Lowes Synchrony card to other credit cards, it's important to consider the unique benefits it offers. While other cards may provide general rewards, the Lowes Synchrony card focuses specifically on home improvement needs.

Competitive Analysis

In comparison to cards like Home Depot or Best Buy, the Lowes Synchrony card often provides better no-interest financing terms and more targeted rewards for home improvement purchases.

Tips for Maximizing Benefits

To fully leverage the benefits of the Lowes Synchrony card, consider the following tips:

- Always pay your balance in full before the promotional period ends to avoid interest charges.

- Regularly check your account for updates on available promotions and discounts.

- Utilize the Lowes mobile app for easy access to your rewards and account information.

Best Practices

Staying informed about the card's features and benefits ensures you maximize its value. Regularly review your statements and take advantage of all available perks.

Conclusion and Final Thoughts

The Lowes Synchrony card is a powerful financial tool for anyone looking to enhance their home improvement projects. With its no-interest financing, cashback rewards, and exclusive discounts, it offers a comprehensive solution for managing home-related expenses. By understanding the card's features and utilizing its benefits effectively, you can achieve significant savings and improve your financial well-being.

We encourage you to share your thoughts and experiences in the comments below. If you found this guide helpful, please consider sharing it with others who might benefit from the information. Additionally, explore our other articles for more insights into personal finance and home improvement strategies.

For more information on the Lowes Synchrony card, visit the official Lowes website or contact Synchrony Bank directly for detailed inquiries.

Data and statistics referenced in this article are sourced from reputable financial publications and the official Lowes and Synchrony Bank websites, ensuring accuracy and reliability.